Do you sell an online course, digital program or digital subscription, templates, audio/video/text files, SVG files, digital patterns, or another type of digital product? Here is your checklist guide to getting this specific type of online business legally buttoned down:

# 1 – Make sure you have the proper rights to whatever content you are selling

Which means either:

- You created it (with your own hands, voice, camera, computer, phone, etc)

- Or you got it from someone else and you have a proper license (in writing) to use it commercially

You can use a simple contract like the copyright assignment contract to handle this (this a bare-bones CYA, especially for things that you are selling where nothing was in writing!) or it could be covered in an independent contractor agreement if you hired someone to create something for you.

So, if you used a freelancer or independent contractor (sometimes calls a 1099-er) to help you in your business like a virtual assistant, graphic designer, illustrator, hand-letterer, web designer, social media manager, Pinterest manager, customer care specialist, integrator, online business manager, copywriter, etc), then hand that person an independent contract agreement from now and forever more to get all that lovely content properly transferred to your business “pot”.

# 2 – Get your “naked” website footer covered with website legal documents

Your website is your home base and it should be a solid, professional place, especially if you are collecting information (hello email list!) and selling digital products from it. The footer of your website needs:

- Privacy policy

- Website terms (also called terms and conditions, Terms of use/TOU, or terms of service, somewhat interchangeably)

-

© Copyright Statement

- Any necessary disclaimers or disclosures based on what information and offers are on your site.

You can find all of the documents above, plus a step-by-step video guide on how to use them, in my best-selling all-in-one Website Legal Bundle.

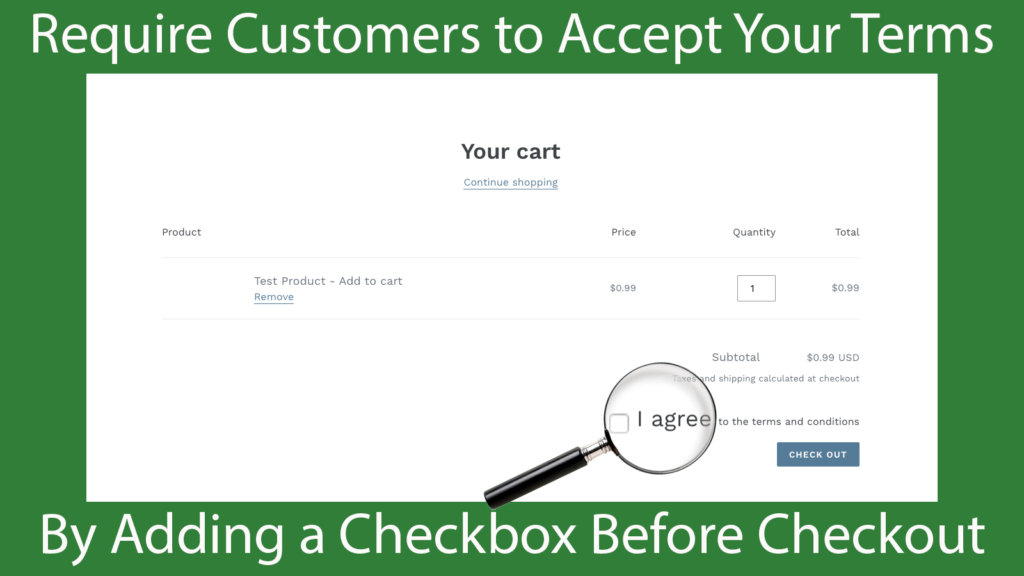

# 3 – Set up proper boundaries with terms and conditions for your customers on checkout

If you sell products on your own website (regardless of the website platform), you need some terms and conditions (T&C)/terms of use/terms of service (they’re all the same thing – RULES) that the consumer will “check-the-box” to during checkout, like here:

Here are specific terms of use templates/TOU for:

For digital products, these terms should have:

-

- A clear refund policy

- Copyright policy (e.g. what can people do — or not do — with your content)

- Payment terms (if there is a payment plan or auto-renew/subscription)

- Any terms around bonuses or other promotional offers that need to be clarified

- For user-generated content that will become part of the product (group calls, Zoom sessions, reviews, notes or feedback from meetings, make sure you have a media release to use that content)

If you ONLY sell on a marketplace (like TPT, Etsy, Creative Market), you usually don’t have the option of making your customers agree to your specific terms by being on your website (instead the users will be bound by the marketplace terms). So, your options are to:

- Include some terms of use/license language in the product description

- Include the terms of use/license language in the actual product itself (a .pdf in the file, for example). This is not IDEAL since binding contracts really need to be agreed to BEFORE purchase. But, it’s better than nothing.

# 4 – Incorporate, or register your LLC with your state

Without setting up a proper legal entity, you are operating as a sole proprietorship, which means your personal money and business money are all mixed together (and available for grabs if you get sued!) To put a nice big fence between your business money and your personal money (your car, home, savings account, retirement, assets with a spouse, etc) – please set up a limited liability company, or an LLC (the easiest and cheapest option!) or a corporation.

How? You can DIY, hire a third-party service (which I don’t recommend, because they tend to be a rip-off…cough, cough LegalDoom), or hire a local attorney.

To DIY your LLC and find your state business portal: Google “your state + LLC registration” and look for the .gov result (not the Legalzom/Incfile/zenbusiness links!).

Tip: If you want to preserve privacy and you work from your home, make sure to set up a virtual mailbox AND a commercial registered agent and have those addresses ready when you submit your LLC paperwork online to your state portal. (I like Anytime Mailbox and iPostal1 for virtual mailboxes, but don’t get suckered into adding on any other services, you can file you DIY online by yourself in every state!)

After getting your LLC set up, use the same LLC name to get an FEIN or Tax ID from the IRS here. It is free and should take 5 minutes. (here’s a video tutorial on using the IRS EIN application site). Biggest takeaway= Don’t lose this number!! They’re a huge pain to look up (as in the IRS may NEVER answer their phone).

5 – Sign that business marriage prenup

If you have a business partner or partners and are thus “business married” , you need to get an Operating Agreement or “business prenup” signed between you! (also highly recommend these two episodes of my Creative Counsel Podcast all about creating and fixing business partnerships). An operating agreement is a binding document that outlines the ownership, decision-making, and exit planning for your business. It may also be known as a founder’s agreement, partnership agreement, or buy-sell agreement.

If you are working or collaborating with someone else, but have not formed a new business entity or company yet (but are sharing revenues and/or expenses from a product, program, or course), you should really have something in writing clarifying that relationship like the Course Collaboration Agreement.

6 – Set up proper boundaries with team members

If you use freelancers or independent contractors (sometimes calls a 1099-er) to help you in your business (such as a virtual assistant or VA, graphic designer, web designer, social media manager, Pinterest manager, customer care specialist, integrator, online business manager, copywriter, etc), then hand that person an independent contractor agreement. An independent contractor should have a CONTRACT! If the contractor has a client service agreement they want you to sign – your options are:

- Two “dueling” contracts (not recommended)

- You can insist the contractor sign YOURS, or

- You sign the contractor’s, but negotiate or redline any terms so that it matches what you have in YOUR trusty contract (that comes with a video guide, so you know what’s actually important in these agreements!)

Getting “people” legit – setting up clear boundaries with your CEO hat on

When you’re a business owner, you need to think differently about “boundaries” and how clear expectations can help EVERYBODY have a better relationship as your business grows and gets more complicated (and fun!) You may need to add other legal agreements if you offer these things in your business:

If you have started offering VIP days (or want to!), these offerings have some special prep and boundaries that need to go into them to make them successful for both sides, so use a good VIP DAY client service agreement.

If you host events, you need an event waiver/release.

If you take photos or videos of people to use in your business, have them sign a model release (sometimes called a media release.)

If you run an affiliate program (where people are affiliates for YOUR offering), you should have them agree to these affiliate terms when they sign up for your affiliate program.

If you run online giveaways, you need some fine print for the social media posts and on your website.

If you have a podcast or video/YouTube show where you host guests, send a blogger guest release or podcast guest release as part of your booking workflow.

If you use testimonials in your marketing, use a testimonial release to make sure you have permission to share.

If you use influencer collaborations either as the creator/influencer, brand, or agency intermediary, highly recommend a solid influencer brand agreement.

If you are providing 1:1 services, make sure you have a solid client service agreement to protect that revenue stream.

Want more guidance? If you’d like a step-by-step roadmap on getting a modern online business legally legit, download the FREE legally legit workbook!

Do you like to listen and learn? Tune into the Creative Counsel Podcast with attorney Brittany Ratelle to get business operations action items, inspiring founder stories (including the highs and the lows and what they would have done differently), and tips from leading online business leaders.

Be the first to comment